Average Property Taxes In Scarsdale Ny . Tuesday, 08 june 2021 09:34. there are 3 property tax billings per year: the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. * rates are per $1,000 of assessed value. Taxes may be paid online. * rates are per $1,000 of assessed value. The average assessed value of a single family home in scarsdale. Wondering how much your real estate taxes will be next year?. School and village taxes can be paid in two installments. the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. the following real property taxes are billed to residents of the village/town of scarsdale: the assessor’s department (“department”) prepares an assessment roll of all real property, vacant and improved, within the. there are three property tax billings per year:

from www.mtpr.org

Wondering how much your real estate taxes will be next year?. Tuesday, 08 june 2021 09:34. * rates are per $1,000 of assessed value. the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. there are three property tax billings per year: the assessor’s department (“department”) prepares an assessment roll of all real property, vacant and improved, within the. School and village taxes can be paid in two installments. the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. there are 3 property tax billings per year: * rates are per $1,000 of assessed value.

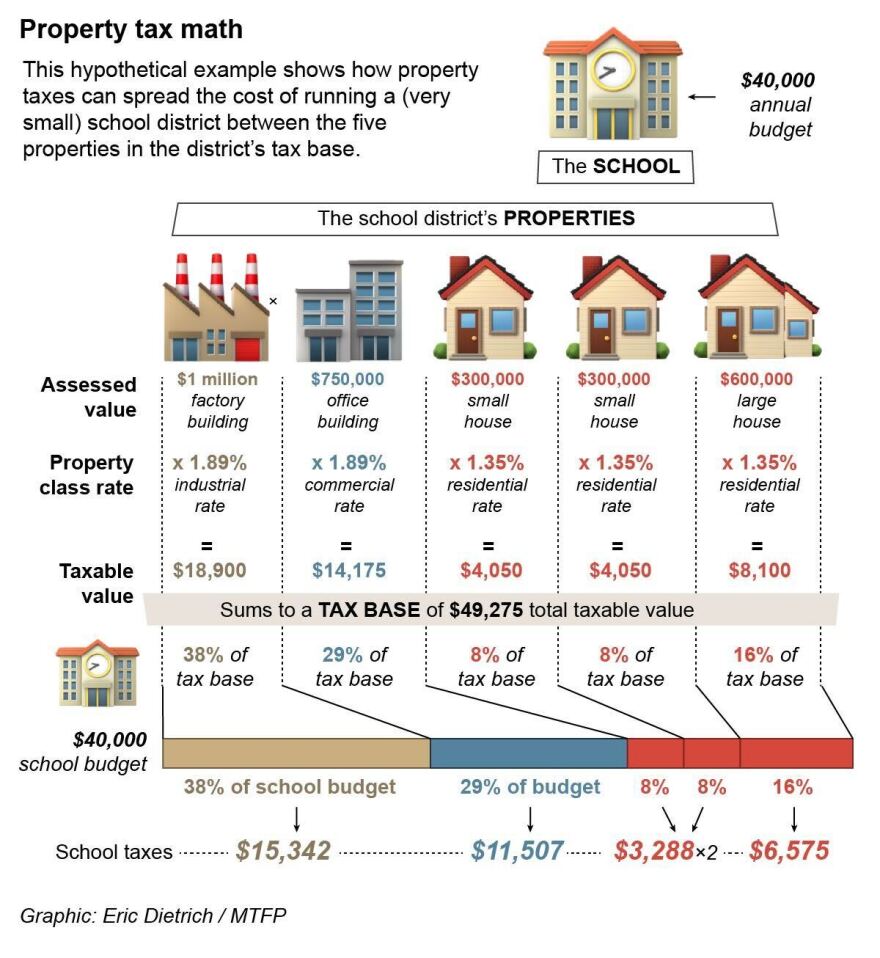

Property taxes, explained — with pictures Montana Public Radio

Average Property Taxes In Scarsdale Ny the assessor’s department (“department”) prepares an assessment roll of all real property, vacant and improved, within the. the following real property taxes are billed to residents of the village/town of scarsdale: The average assessed value of a single family home in scarsdale. the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. Taxes may be paid online. there are three property tax billings per year: the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. there are 3 property tax billings per year: Wondering how much your real estate taxes will be next year?. School and village taxes can be paid in two installments. Tuesday, 08 june 2021 09:34. the assessor’s department (“department”) prepares an assessment roll of all real property, vacant and improved, within the. * rates are per $1,000 of assessed value. * rates are per $1,000 of assessed value.

From www.crainsnewyork.com

New York commuter counties top list for highest property taxes Crain Average Property Taxes In Scarsdale Ny The average assessed value of a single family home in scarsdale. School and village taxes can be paid in two installments. the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. Wondering how much your real estate taxes will be next year?. Tuesday, 08 june 2021 09:34.. Average Property Taxes In Scarsdale Ny.

From www.cashbuyersny.com

Latest Property Taxes in New York State Cash Buyers NY Average Property Taxes In Scarsdale Ny the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. * rates are per $1,000 of assessed value. * rates are per $1,000 of assessed value. the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average. Average Property Taxes In Scarsdale Ny.

From www.taxmypropertyfairly.com

Upstate NY Has Some of the Highest Property Tax Rates in the Nation Average Property Taxes In Scarsdale Ny the following real property taxes are billed to residents of the village/town of scarsdale: the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. Wondering how much your real estate taxes will be next year?. the assessor’s department (“department”) prepares an assessment roll of all. Average Property Taxes In Scarsdale Ny.

From www.retax.com

Scarsdale, New York A Lovely Village Property Tax Appeal Service Average Property Taxes In Scarsdale Ny The average assessed value of a single family home in scarsdale. * rates are per $1,000 of assessed value. the following real property taxes are billed to residents of the village/town of scarsdale: * rates are per $1,000 of assessed value. there are three property tax billings per year: the assessor’s department (“department”) prepares an assessment roll. Average Property Taxes In Scarsdale Ny.

From www.paramountpropertytaxappeal.com

Harris County Property Tax site Average Property Taxes In Scarsdale Ny * rates are per $1,000 of assessed value. Wondering how much your real estate taxes will be next year?. Taxes may be paid online. there are 3 property tax billings per year: the assessor’s department (“department”) prepares an assessment roll of all real property, vacant and improved, within the. the median property tax in westchester county, new. Average Property Taxes In Scarsdale Ny.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Average Property Taxes In Scarsdale Ny there are three property tax billings per year: The average assessed value of a single family home in scarsdale. the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. * rates are per $1,000 of assessed value. * rates are per $1,000 of assessed value. Tuesday,. Average Property Taxes In Scarsdale Ny.

From patch.com

Here's The 'Average' Property Tax Bill In Newark Newark, NJ Patch Average Property Taxes In Scarsdale Ny * rates are per $1,000 of assessed value. School and village taxes can be paid in two installments. The average assessed value of a single family home in scarsdale. the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. Tuesday, 08 june 2021 09:34. there are. Average Property Taxes In Scarsdale Ny.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Average Property Taxes In Scarsdale Ny * rates are per $1,000 of assessed value. School and village taxes can be paid in two installments. the assessor’s department (“department”) prepares an assessment roll of all real property, vacant and improved, within the. the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. The. Average Property Taxes In Scarsdale Ny.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Average Property Taxes In Scarsdale Ny the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. The average assessed value of a single family home in scarsdale. * rates are per $1,000 of assessed value. the following real property taxes are billed to residents of the village/town of scarsdale: the median. Average Property Taxes In Scarsdale Ny.

From taxfoundation.org

How Does Your State Rank on Property Taxes? 2019 State Rankings Average Property Taxes In Scarsdale Ny The average assessed value of a single family home in scarsdale. the following real property taxes are billed to residents of the village/town of scarsdale: School and village taxes can be paid in two installments. Tuesday, 08 june 2021 09:34. Taxes may be paid online. * rates are per $1,000 of assessed value. there are 3 property tax. Average Property Taxes In Scarsdale Ny.

From printablethereynara.z14.web.core.windows.net

Virginia State Sales Tax Rate 2024 Average Property Taxes In Scarsdale Ny the assessor’s department (“department”) prepares an assessment roll of all real property, vacant and improved, within the. the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. Taxes may be paid online. the following real property taxes are billed to residents of the village/town of. Average Property Taxes In Scarsdale Ny.

From patch.com

Are Property Tax Grievances Pillaging the Village? Scarsdale, NY Patch Average Property Taxes In Scarsdale Ny the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. the following real property taxes are billed to residents of the village/town of scarsdale: Tuesday, 08 june 2021 09:34. * rates are per $1,000 of assessed value. Taxes may be paid online. Wondering how much your. Average Property Taxes In Scarsdale Ny.

From www.armstrongeconomics.com

US Property Tax Comparison By State Armstrong Economics Average Property Taxes In Scarsdale Ny * rates are per $1,000 of assessed value. there are 3 property tax billings per year: Tuesday, 08 june 2021 09:34. there are three property tax billings per year: the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. the following real property taxes. Average Property Taxes In Scarsdale Ny.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Average Property Taxes In Scarsdale Ny the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. The average assessed value of a single family home in scarsdale. there are 3 property tax billings per year: * rates are per $1,000 of assessed value. Taxes may be paid online. the median property. Average Property Taxes In Scarsdale Ny.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Average Property Taxes In Scarsdale Ny the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. the median property tax in westchester county, new york is $9,003 per year for a home worth the median value of $556,900. * rates are per $1,000 of assessed value. the following real property taxes. Average Property Taxes In Scarsdale Ny.

From www.youtube.com

What is the average property tax bill in NYC? YouTube Average Property Taxes In Scarsdale Ny Wondering how much your real estate taxes will be next year?. the following real property taxes are billed to residents of the village/town of scarsdale: the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. the assessor’s department (“department”) prepares an assessment roll of all. Average Property Taxes In Scarsdale Ny.

From thecolumbusceo.com

Property Taxes Are 16.8 Of Tax Revenue, Above U.S. Average Average Property Taxes In Scarsdale Ny * rates are per $1,000 of assessed value. * rates are per $1,000 of assessed value. The average assessed value of a single family home in scarsdale. School and village taxes can be paid in two installments. there are 3 property tax billings per year: there are three property tax billings per year: the assessor’s department (“department”). Average Property Taxes In Scarsdale Ny.

From paheld.com

New York City Property Taxes (2023) Average Property Taxes In Scarsdale Ny there are three property tax billings per year: the median property value in scarsdale, ny was $1.64m in 2022, which is 5.8 times larger than the national average of $281,900. * rates are per $1,000 of assessed value. the median property tax in westchester county, new york is $9,003 per year for a home worth the median. Average Property Taxes In Scarsdale Ny.